Christina’s Case: Elizabeth Warren leads student loan reform effort

April 28, 2014

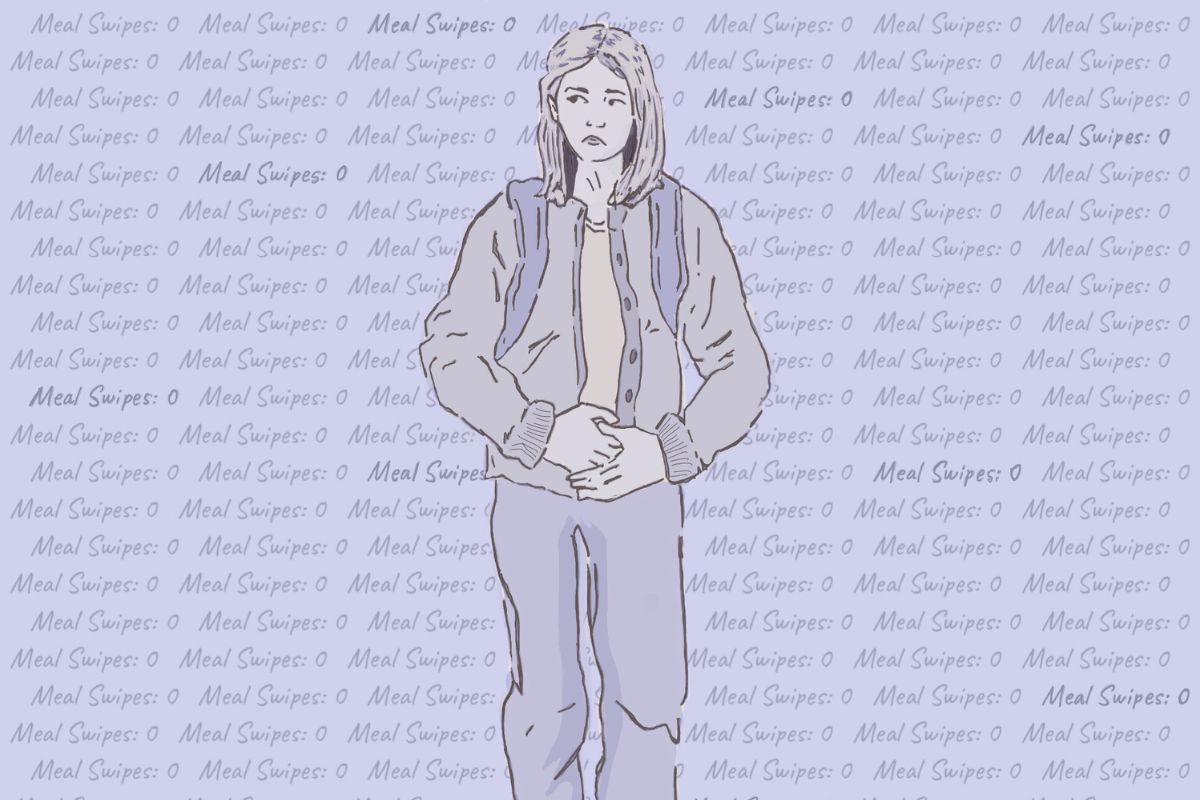

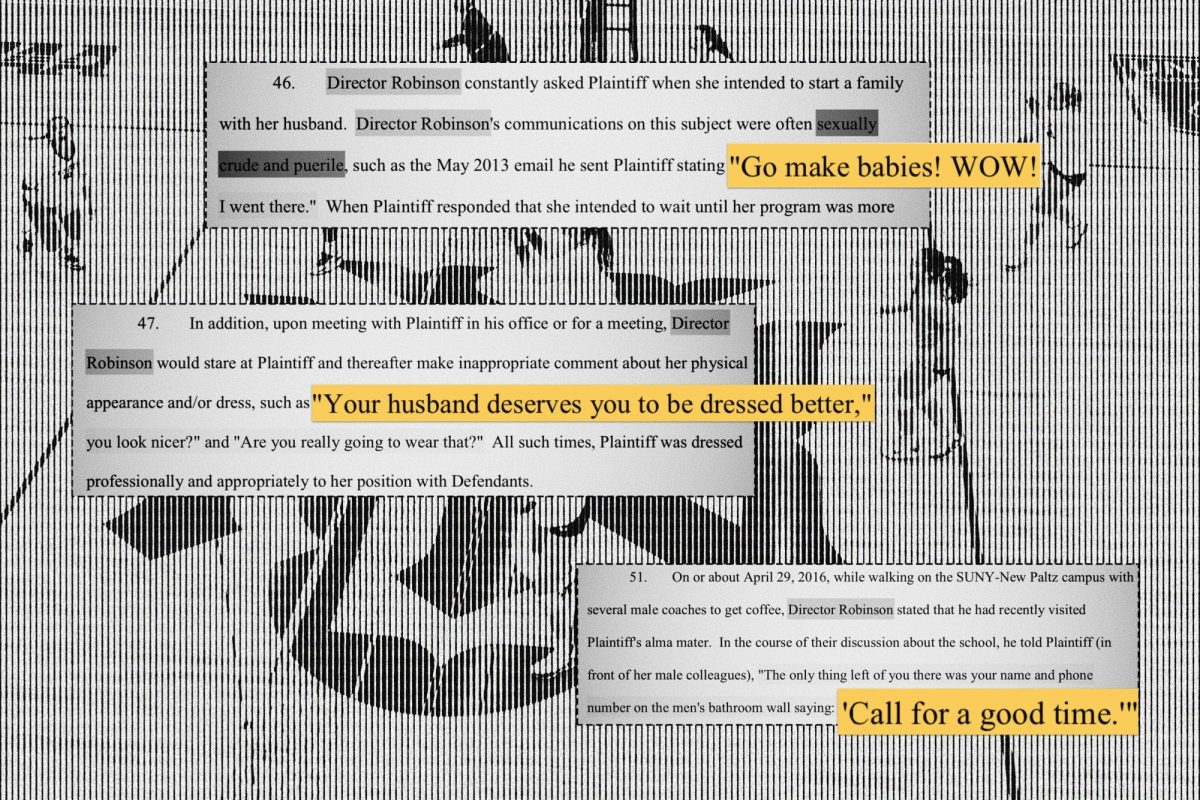

The student loan bubble is beginning to burst, necessitating solutions to the $1.2 trillion crisis and 40 million indebted Americans. Nearly tripling between 2004 and 2012, research shows that student loan debt is the only form of consumer debt that has increased since the 2008 peak, with balances surpassing both credit cards and auto loans. Outstanding student debt has doubled since 2007 and defaults, with 15 percent of borrowers defaulting within three years, are at a 20-year high. The issue is particularly entrenched in our school — NYU created more debt than any other American university in 2011, excluding for-profit institutions. This crisis not only hinders students and their families, but also deters economic progress. Despite the impending gravity of this problem, Congress has yet to meaningfully act. After months of partisan squabbles — the GOP notably rejecting a bill to lower student loan rates and supporting the repeal of a student loan reform law — the Senate failed to reduce student loan rates last July.

Despite congressional sluggishness, Sen. Elizabeth Warren is one of the few representatives — including Kirsten Gillibrand, Dick Durbin and Jack Reed — who has taken a palpable stand for reforming the broken system. She has presented several reforms to combat increasing higher education costs. Warren’s call to action should serve as a reminder to Congress that the student debt crisis is urgent and requires substantial action on both sides of the isle. In an April 22 interview with MSNBC’s Rachel Maddow, Warren said she would reintroduce legislation to refinance federal student loans at a rate of 3.86 percent using the Buffett Rule.

Although this idea is only a starting point for combating the growing crisis, her spotlighting student loan debt will hopefully inspire other representatives to develop solutions. As of early 2012, the average student loan balance for all age groups is $24,301. About one-quarter of borrowers owe over $28,000 and 10 percent of borrowers owe over $54,000. Furthermore, 3 percent owe over $100,000. Our representatives must realize that student debt is not an abstract concept but an actual hindrance to individual advancement. Students can find themselves massively indebted in a job market that may require graduate school — another expensive endeavor that may not guarantee employment.

The bursting student loan debt bubble equates to far more than partisan divides for students and families across the nation, including many on this campus. Conservatives show ignorance toward the larger picture by attempting to diminish Warren’s credibility, for example by deriding her personal wealth and background in academia. While Warren’s proposal may not solve the crisis in its entirety, she is one of the few senators who is giving this problem the attention it deserves. Instead of making false claims that Warren disparages capitalism, her opponents should compel Republicans to devise feasible alternatives to address the $1.2 trillion crisis — preferably ones without the strong potential to cost students more in the long run, a concern some had with last May’s H.R. 1911. Until then, opponents should amplify their voices as Warren has — if not for the bipartisan nature of this cause, then for college students and the American economy.

A version of this article appeared in the Monday, April 28 print edition. Christina Coleburn is a deputy opinion editor. Christina’s Case is published every Monday. Email her at [email protected].