Financial crisis remains, says expert

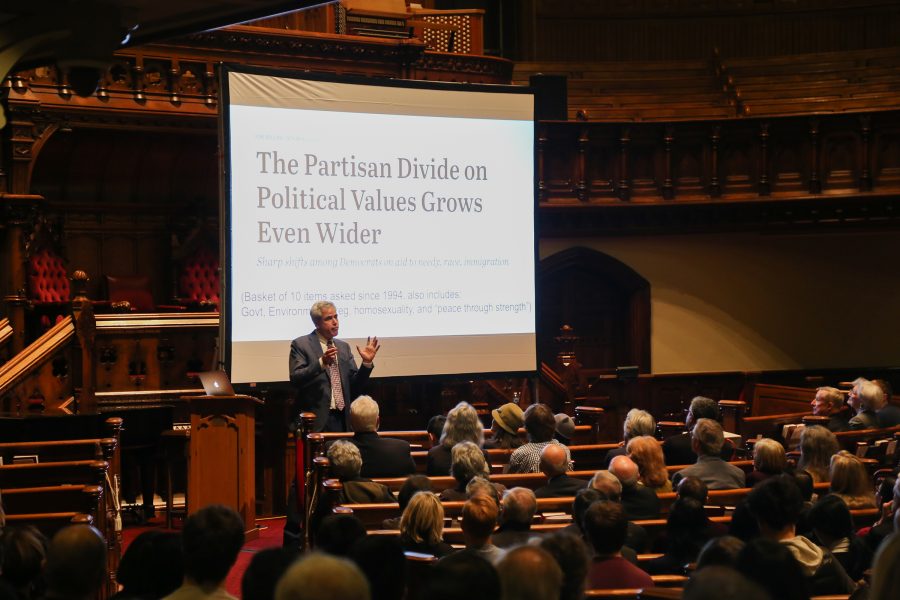

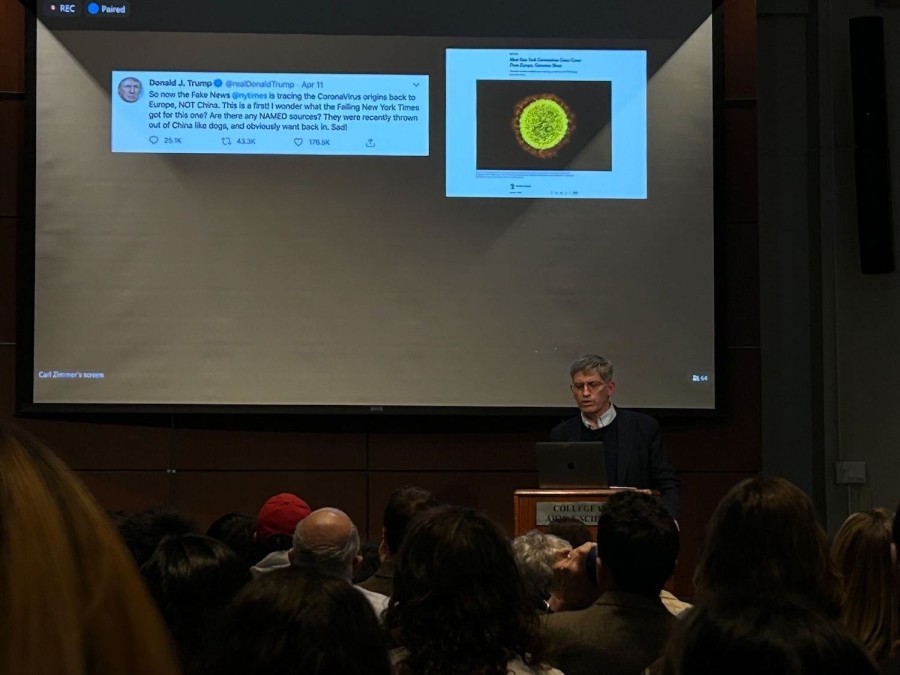

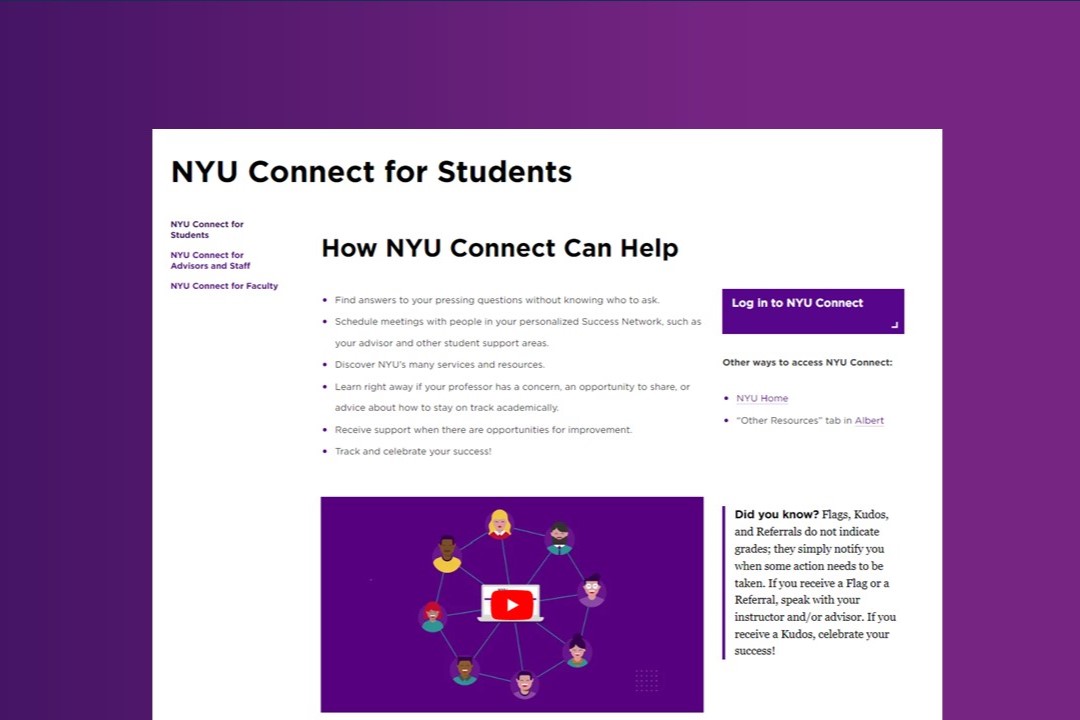

UCLA historian and professor Robert Brenner delivers his lecture “The U.S. Economy Today and Tomorrow: Inequality, Stagnation, Crisis” at Jurow Lecture Hall in Silver Center on Tuesday.

November 19, 2014

NYU visiting sociology professor Robert Brenner spoke about how the 2008 financial crisis continues to impact today’s economy during a discussion held on Nov. 18.

“The financial crisis was responsible for the problems of the real economy, which only began to appear after the crisis hit,” Brenner said. “The Wall Street meltdown is an outgrowth of the declining economy.”

At a lecture in the Jurow Lecture Hall, Brenner laid out the reasons why the fall of the rate of profit has had negative impacts on our economy.

“If you’re a corporate owner and facing falling rate of profit, you have to be concerned to cut cost,” Brenner said. “This comes from a powerful attack by the employers on the unions. Not only to wages get reduced but governments naturally turn to help the corporations cut costs.”

Brenner went on to explain how the attempts of the government to save the economy in the 1990s affected the current economic situation in the United States.

“The idea was to make it possible for these entities to be able to spend and drive the economies,” Brenner said. “Make interest rates low, allow financial investors a big opening to invest privately in markets like the stock market or housing market, drive up speculatively the prices of, say, equities or housing. That would mean that the corporations have much increased market capitalization. This allows corporations and households who have no capacity really to borrow suddenly to be wealthy.”

Brenner said corporations attempt to address economic problems by raising productivity and lowering wages.

“They push down wages,” Brenner said. “They raise productivity by making workers work harder. No new machinery. In that way, they were able to somewhat raise their rate of profit. They were faced with problem they themselves created.”

Brenner continued to describe how the economy went forward into the new millennium.

“Paradoxically, the households of middle and working class people, their spending drove the economy,” Brenner said. “In part, the economy was saved by its own weakness. Nobody is investing, employing, demanding loans. This opens the way to the next bubble, a bubble that is driven by the cheap cost of borrowing.”

Brenner said he believes these kinds of bubbles have led to the current inequality of the classes.

“There is incredible bubbling up and its supposed to drive the economy because people are supposed to get rich and spend, but we’ve had the worst economy ever,” Brenner said. “Rich people are being allowed to make money because interest rates are so low.”

CAS freshman Aisha Bosula said she was impressed by the presentation and the use of graphics to explain concepts.

“I thought it was really well delivered and the use of the graphs definitely made it more comprehensive,” Bosula said.

CAS sophomore Nick D’Angelo said Brenner’s explanation of the United States’ economic history was comprehensive and shed light on the current state.

“I thought it was a very fascinating economic analysis,” D’Angelo said. “It’s very alarming and the implications are certainly terrifying, but I thought it was a convincing case and it was a coherent economic history of the last 30 to 40 years.”

A version of this article appeared in the Wednesday, Nov. 19 print edition. Email Olivia Wetzel at [email protected].