Law school debt crisis will avoid NYU

November 4, 2015

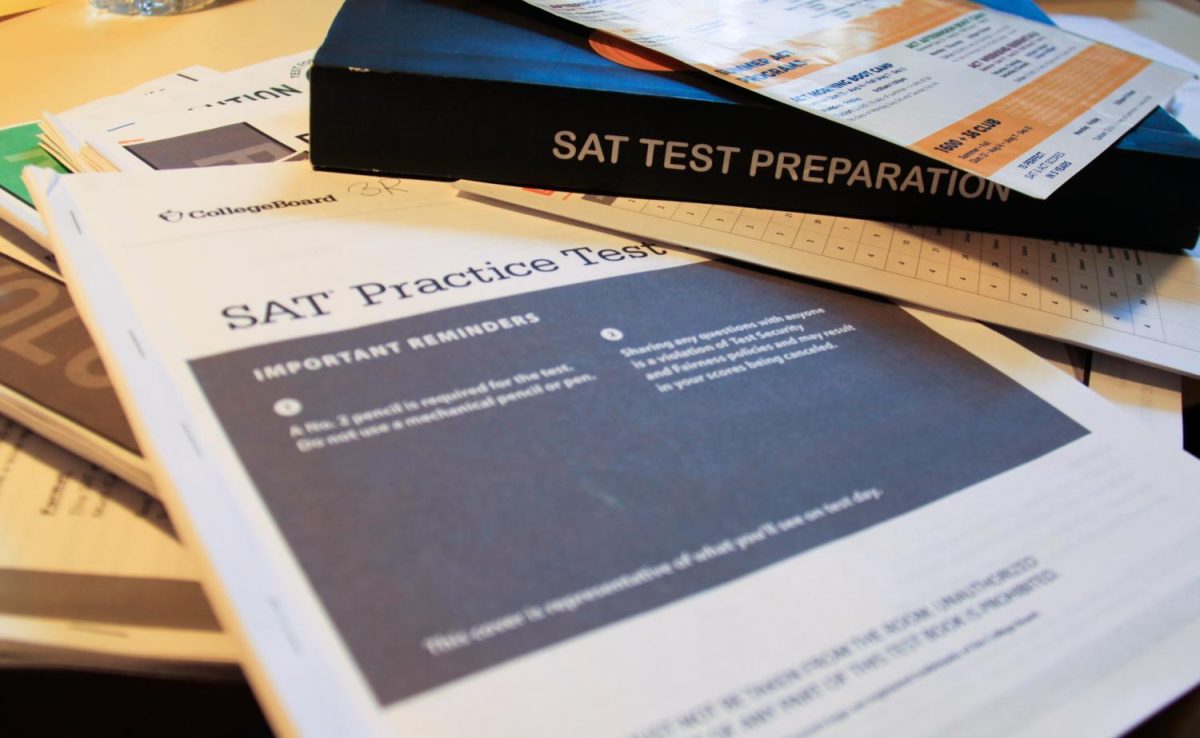

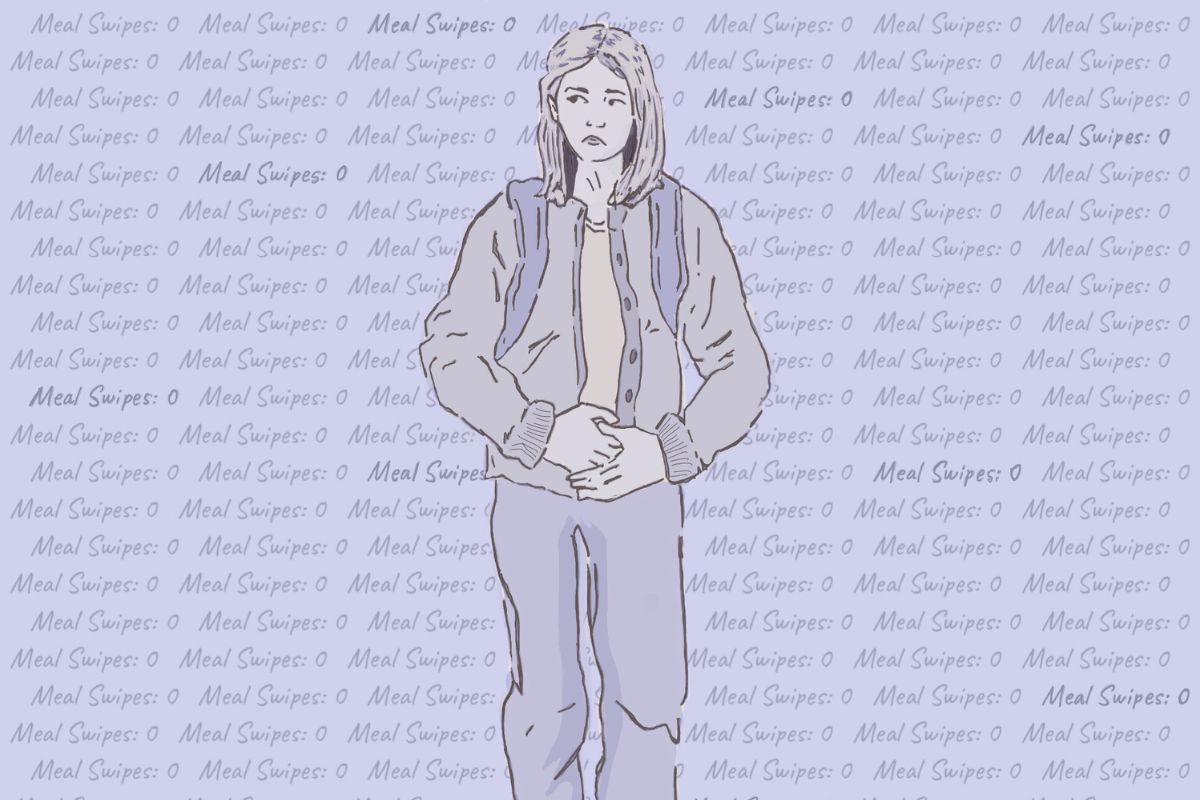

According to a recent article published in the New York Times, U.S. law schools are facing a major debt crisis. The issue is most severe among for-profit schools, which feature high tuition and student debt rates coupled with low Law School Admission Test scores and post-graduation employment. Students at these institutions are simultaneously unqualified to practice law and burdened by hefty amounts of student debt. This deadly combination makes it difficult for them to find quality jobs, leaving them unequipped to pay off their huge student loans. America’s taxpayers, rather than the unemployed law school graduates, are forced to bear the burden of these unpaid loans. This system is not only unfair to students and taxpayers, but is also dangerous to the health of the United States’ legal education system, sowing seeds of doubt among those who want to enter the world of legal practice.

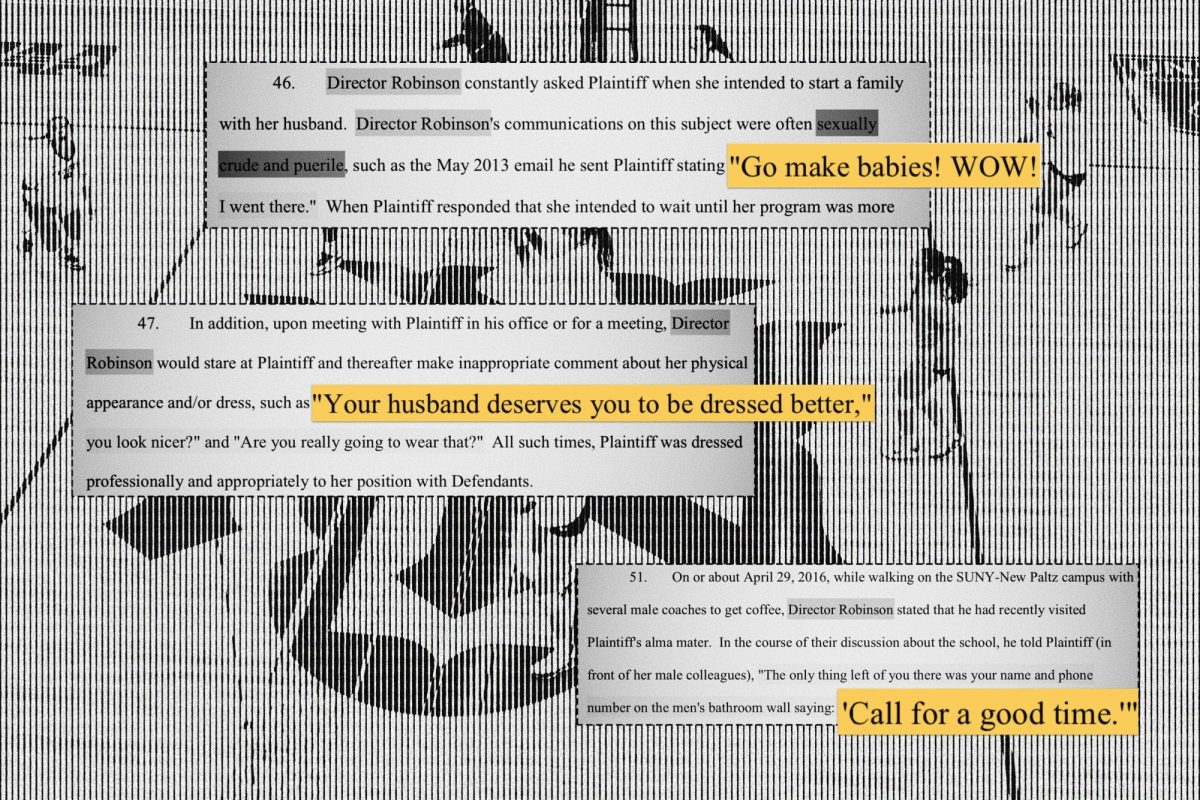

The root cause of this problem, to nobody’s surprise, is the money-hungry nature of for-profit academic institutions. An expansion in 2006 of the PLUS loan’s reach has been manipulated by for-profit law schools, which have raised tuition and increased their numbers of admitted applicants to rack in larger sums of cash. Simultaneously, these schools have lowered their admissions standards in response to dwindling numbers of applicants, a result of the market for lawyers shrinking during the recession. The for-profit Florida Coastal School of Law, for example, admits students with LSAT scores falling in the bottom quarter of national scores. This pool of admitted students is so unqualified that LSAT administrators are unsure if they will pass the bar exam, making a career in law a futile and naive aspiration for the nearly one in three students who do not pass.

Fortunately for students enrolled at NYU, this crisis will be smoothly averted. Even though the total cost of attending NYU’s law school from 2015-2016 amounts to a terrifying $85,964 and less than 40 percent of students receive scholarship aid, students get plenty of bang for their buck. Students admitted into the law school’s Fall 2015 term, for example, were highly qualified: those in the 75th percentile had LSAT scores of over 171 and an undergraduate GPA of 3.9 or higher. After graduation, 97.5 percent of students from NYU Law’s class of 2014 were employed, 69.16 percent specifically in law firms. This is above the nation’s average of 40.7 percent of total graduates employed as lawyers. With New York City housing some of the highest-earning lawyers in the United States and starting salaries already in the six figures, debt repayment and career success seem probable for prospective lawyers at NYU.

A potential solution to this calamity is making the criteria for a school’s federal student loan eligibility stricter. Obama’s administration has extended the gainful employment rule so that only schools which adequately prepare their students for a career that will allow them to pay off their debt are eligible for loans. The Times article suggests extending this rule to non-profit schools and establishing a limit for the number of loans a school or student can receive. Both of these are effective methods to curb for-profit law schools’ greedy tendencies.

Opinions expressed on the editorial pages are not necessarily those of WSN, and our publication of opinions is not an endorsement of them.

Email Katrina Wilson at [email protected].