Nationwide Tuition Hikes Are the Spookiest News of All

October 28, 2016

While many colleges have been assuring students that their yearly tuition increases will soon finally start to slow down, a recent report released by the College Board has shown that educational costs nationwide are on the rise. The study found that although the published tuition increases seemed moderate, the overall net cost increase for students was outrageously high. College affordability has already been a hot-button topic this year — thanks in part to the charged nature of the election season — but this report only further raises the question of how low- and moderate-income students will ever be able to afford their education in the years to come.

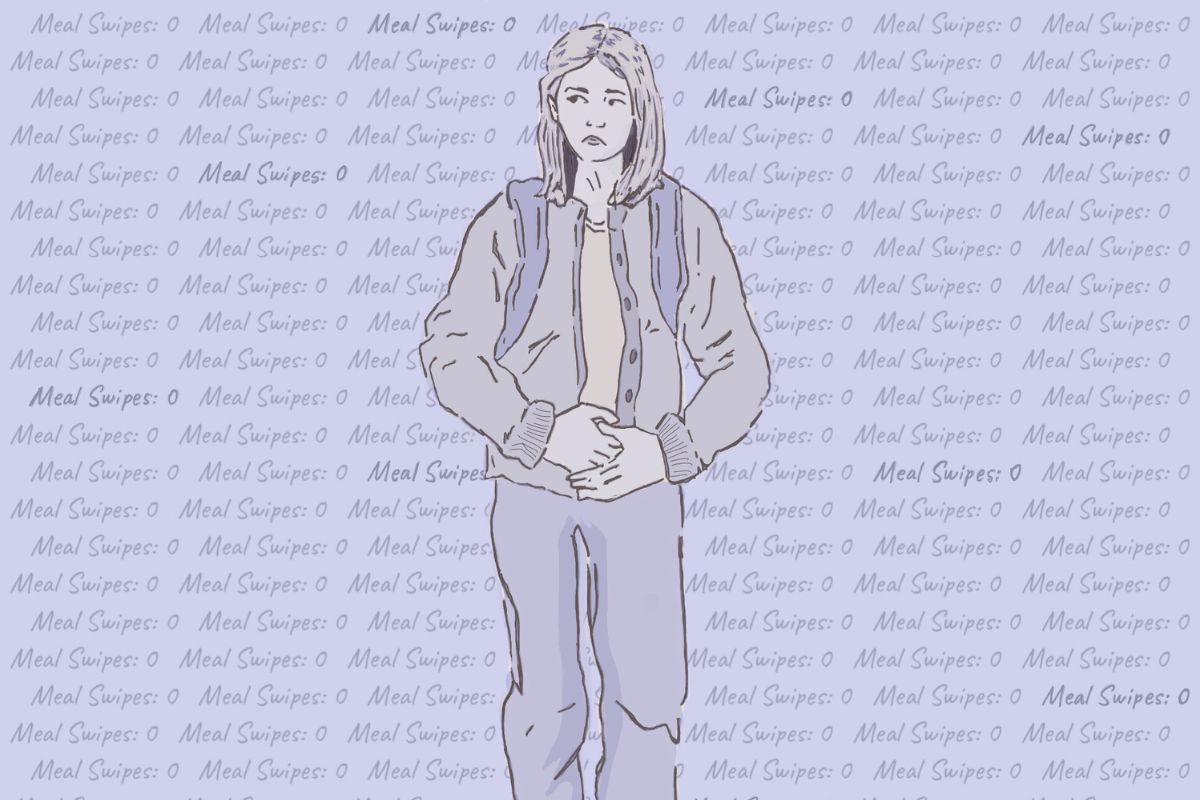

The published tuition rates for the 2016-17 school year reflect an increase of approximately 2.2 to 3.6%. While this figure does not seem particularly momentous upon first glance — especially when viewed in conjunction with the cost spikes found in previous years — it is anything but insignificant. Obviously tuition can be expected to rise from year to year as inflation occurs, but these yearly college cost hikes reflect something entirely different. The 2016-17 increase has outpaced the growth rates for overall inflation, family incomes and federal financial aid. This does not bode well for students attempting to enter the higher education sphere. With college costs on the rise and grant amounts dropping, it seems unlikely that prospective students with lower socioeconomic statuses will be able to keep up.

While the issue itself is worrisome on its own, the lasting effects on the American economy have the possibility to be far scarier. Because of the massive college debt students will be inheriting, it is more than likely that they will have to continue to pay it off for the foreseeable future. Debt on such a nationwide scale could easily hinder entire generations from being able to fully gain independence from their families, advance in their careers and buy homes. This, coupled with the fact that we as a nation are already experiencing one of the lowest homeownership rates since 1967, suggests a worrying bout of economic stagnation could be in store.

As we near election day, it has become increasingly apparent that issues like college affordability have consequences that reach far beyond just the realm of higher education. While both presidential candidates have put forth plans that address this issue, many of the proposals have been short-sighted and unrealistic. This is not just a student problem: it is an American problem, and voters would be wise to keep this in mind at the ballot box.

Email the WSN Editorial Board at [email protected].