Publicly Available Tax Returns Mean More Transparency

October 11, 2016

Taxes — specifically tax returns — have played a major role in this election cycle. By keeping his returns private, Donald Trump has made history by being the first candidate for president in more than 40 years not to release his tax returns. As an ordinary citizen, Trump is not required to make them public, but this is not the case in other countries. In Norway, part of every filer’s tax return is searchable in public records.

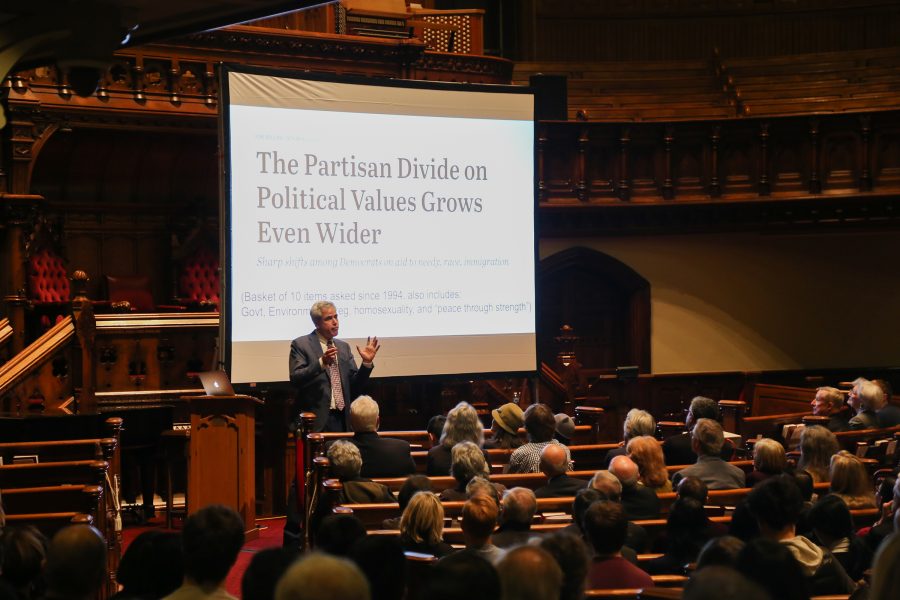

While Trump is being unprecedentedly opaque about his finances, he is not technically breaking campaign rules. Outside the presidential race, no other elected officials are expected to release their tax returns, despite the fact that many of these politicians have shady and incriminating streams of income. In the past year, the two highest ranking members in the state legislature were handed felony sentences for a myriad of bribery, graft and extortion charges. The head of corrections officer union and local political boss Norman Seabrook was indicted on corruption charges this year. It is foolish to assume that our local politicians do not have anything to hide in their tax returns. Many people beyond elected officials have enormous sway over politics, be they union leaders, lobbyists or heads of think tanks. Our elected and unelected leaders must be kept under constant scrutiny. Having their returns automatically available to the public would allow journalists and concerned citizens to peer into the dealings of those in power.

Additionally, the sheer volume of data making tax returns public will give us allows for better analysis our society. Many issues social scientists and policy makers deal with, such as the gender pay gap or income inequality, are difficult to answer because they do not have adequate data. Outside the public record, data can be expensive to collect, unreliable or unrepresentative. However, if tax returns are public record, we could make most of this data readily accessible to researchers. Tax returns give us not only data about ordinary citizens but also about their employers. By aggregating and comparing the data that could be available if returns are made public, researches would be able to track how much companies pay their employees. We can confidently test for pay discrimination. Workers can have more leverage during salary and wage negotiation as all this public data gives them an accurate assessment of their worth to other companies.

More data naturally leads to more transparency. Publicly available tax returns will help us keep those in power in check with the looming threat of their unethical dealings being made public. More data also allows us to better understand ourselves. Adding tax returns to the public record could help us better study everything from inequality to behavior and allow policymakers to craft more effective and targeted policies.

Opinions expressed on the editorial pages are not necessarily those of WSN, and our publication of opinions is not an endorsement of them.

A version of this article appeared in the Tuesday, October 11th print edition. Email Shiva Darshan at [email protected].

Daniel Francis • Oct 12, 2016 at 5:21 pm

The only transparency needed for tax returns is to the government. Those who want “more” transparency than satisfies the government, are immature. Trump is a fearless and exemplary hero by having the courage to stand up against the (stupid) public’s right to know. Norway? Norway who? Does Norway have a Space program? Does Norway have even one world renowned University? When has Norway won even one gold medal at the Olympics? Huh? Huh?