Fact Checking SLAM’s Board of Trustees Claims

NYU SLAM has made a number of claims recently against members of the Board of Trustees in regard to their conflicting interests.

October 30, 2017

At the Student Labor Action Movement’s demonstration on Saturday, Oct. 21, the group paraded posters accusing Board of Trustees members William Berkeley, John Paulson and Anthony Welters of connections to predatory loans, fossil fuels and fracking. SLAM labeled these interests as counter to the interests of the NYU community.

The university has not disputed SLAM’s claims, but NYU spokesman John Beckman denounced the group for making accusations against the trustees, who Beckman said give time and resources to NYU.

WSN delves deeper into SLAM’s claims to determine the facts. SLAM has a zine which explains its stances on various additional members, but WSN has thus far investigated five claims made against the three trustees on posters at last Saturday’s protest.

William Berkeley: “got rich off of predatory student loans”

William Berkeley, who graduated from the Stern School of Business in 1966, headed a private student loan company that offered loans at higher interest rates than federal student loan interest rates.

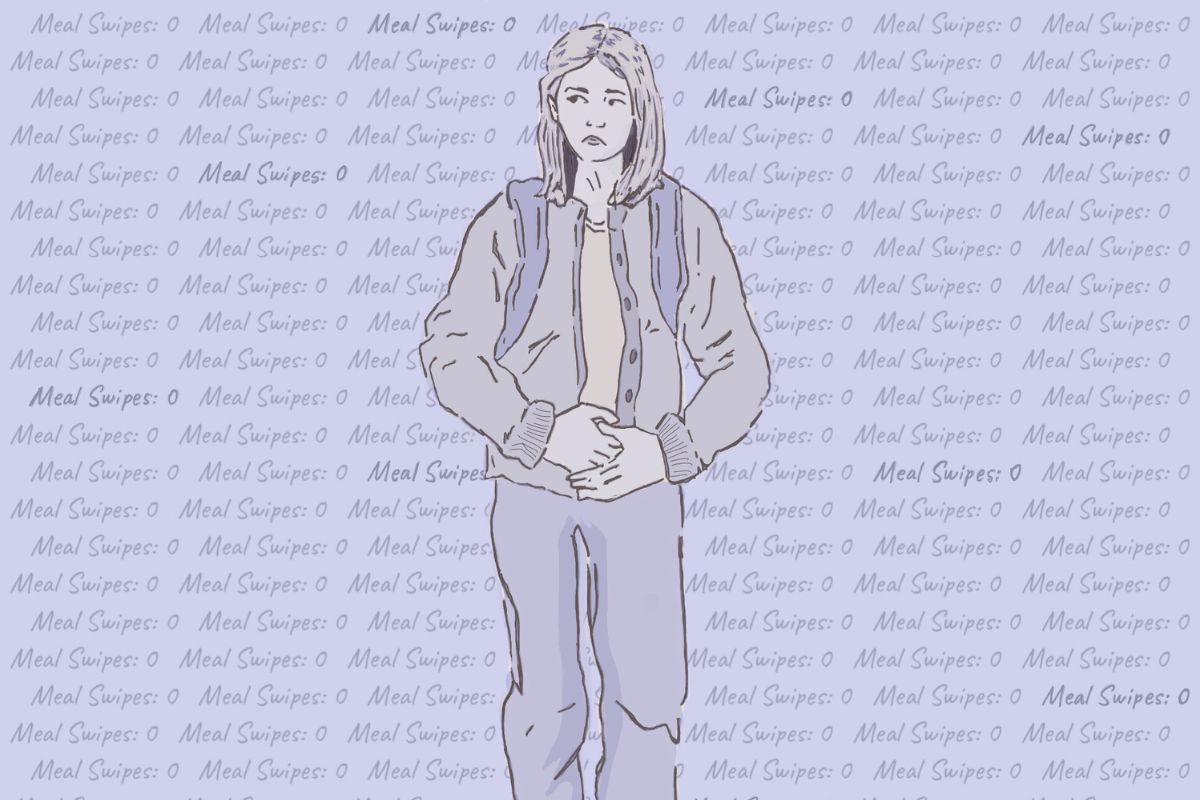

Although it is unclear in what sense exactly SLAM is deeming this practice “predatory,” all interpretations are associated with negative financial consequences. High interest rates on student loans reduce a person’s monthly cash flow, which places financial strain on the people who receive them. When a student pays a lot of money from interest, the student is more likely to fall behind on paying the actual loan. In essence, high interest rates make students more vulnerable to defaulting on their loans. In the United States, one in four borrowers is behind on paying their student loans, and over eight million people are in default.

William Berkeley: “got rich off of fossil fuels”

Berkeley’s company, the W.R. Berkeley Corporation, has a subsidiary called Berkeley Oil and Gas which provides various services to the oil and fossil fuel sectors. According to Hoover, a business database, the annual sales of Berkeley Oil and Gas are estimated to be at $150.3 thousand, but it is unclear how much Berkeley personally receives from the sales of this specific subsidiary or how much the subsidiary contributes to his net worth.

John Paulson: “got rich off of [the] 2008 housing crisis”

John Paulson, who graduated from the Stern School of Business in 1978, is well-known within the financial sector for betting against the U.S. subprime mortgage market and predicting certain components of the 2008 housing crisis, which earned him $2.7 billion in profit.

Paulson’s profit did not come without negatively affecting others. In 2016, Paulson and Goldman Sachs settled after they were sued for fraud by ACA Financial Guaranty Corporation. ACA alleged that Paulson and Goldman Sachs tricked it into insuring Abacus — a collateralized debt obligation that went under in the 2008 financial crisis. ACA and two other investors in Abacus lost an estimated total of $1 billion during the financial crisis.

John Paulson: “got rich off of [the] Puerto Rican debt crisis”

Between 2014 and 2016, Paulson invested an estimated $1.5 billion into Puerto Rican business ventures. An interview with CNN made clear that Paulson believed that during Puerto Rico’s crisis was the best time to seize opportunity, which he compared to Miami’s previous economic crisis. Residents of Puerto Rico have accused businessmen like Paulson of gentrifying the island, forcing financially vulnerable residents to find homes elsewhere.

Paulson has also said that he hopes to move his business offices and personal home to the island. He has been accused of attempting to turn the island into a tax-free haven for the wealthy. According to Bloomberg Pursuits, the Puerto Rican government signed a law in early 2012 that enables people who live in Puerto Rico for at least 183 days out of a year to evade paying federal taxes entirely. However, The New York Times claimed that Paulson actually lost money through his business ventures in Puerto Rico.

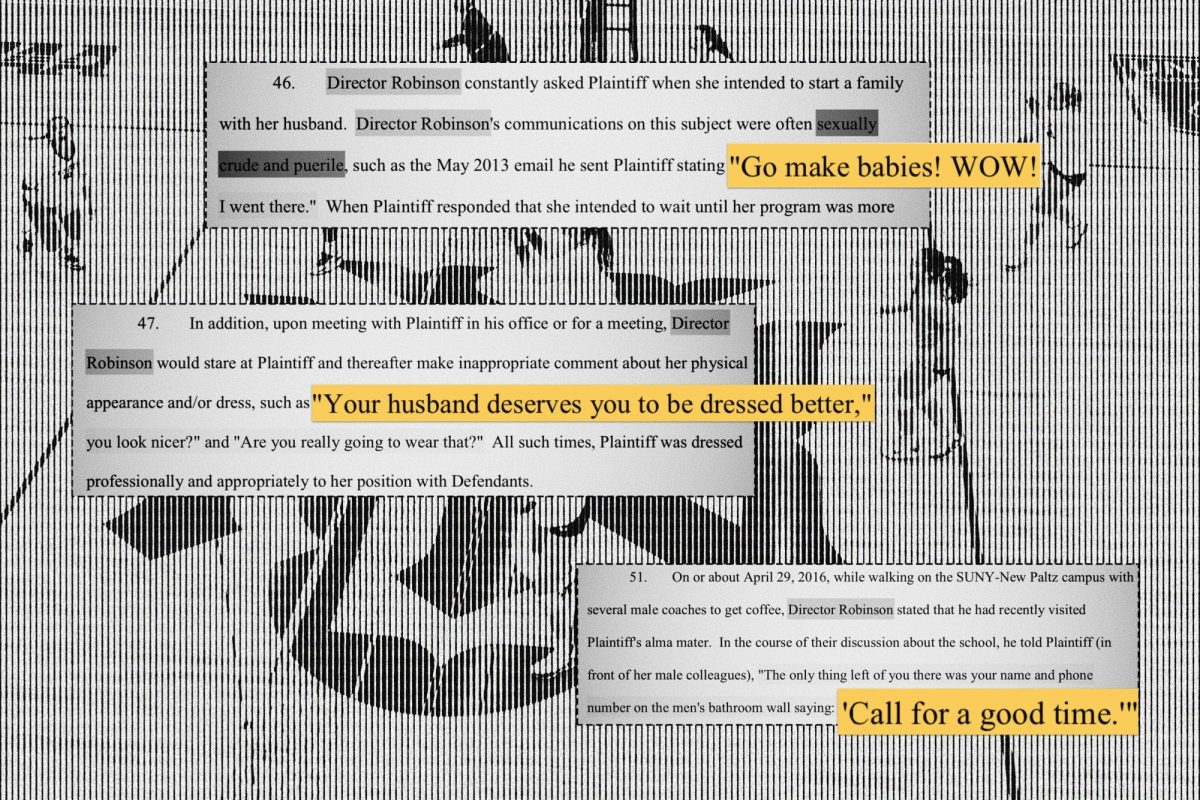

Anthony Welters: “whose fracking company corrupted and poisoned native communities”

Welters, a 1977 graduate of the NYU Law School, served as the executive chairman of the BlackIvy Group and also established Spotted Hawk, a shale gas exploration company.

Spotted Hawk has ventured into several African countries as well as land surrounding Indigenous reservations in the U.S.. Indigenous publications including Indian Country Media Network have accused Spotted Hawk of hurting the health of their lands and communities.

Spotted Hawk is one of multiple companies conducting oil and shale exploration in the Bakken shale formation, which is the home of the Fort Berthold Reservation. This Indigenous community has suffered from local oil and shale exploration.

Rates of murders, aggravated assaults, rapes, human trafficking, robberies and illegal drug trafficking spiked when various oil and shale exploration companies moved into the Bakken region. Indigenous people living in the Bakken region are also vulnerable to respiratory issues, low birth weights and cancers as a result of oil and gas shale exploration.

However, Spotted Hawk is not the only oil and shale exploration company in the Bakken shale formation. The extent to which Spotted Hawk has specifically harmed the local Indigenous community is unknown.

A version of this article appeared in the Monday, Oct.30 print edition. Email Alex Domb and Caroline Haskins at [email protected].