Students Pay Tuition through Cryptocurrency Investments

February 5, 2018

Less than a year after investing a $5,000 principal in cryptocurrencies, like Bitcoin and Ethereum, SPS senior Konig Chen has made enough to pay four years worth of NYU tuition, and then some.

Chen made his initial investment by purchasing coins — the digital currency of many cryptos that have been exploding in popularity in recent years. After seeing extremely high returns in just a matter of months, he invested $45,000 more in August. By January 2018, he had accumulated over $300,000.

“It’s definitely not the normal returns you would get on the stock market,” Chen said. “Because it’s so new and so innovative, one could say that there is no clear price and that’s why it’s so volatile.”

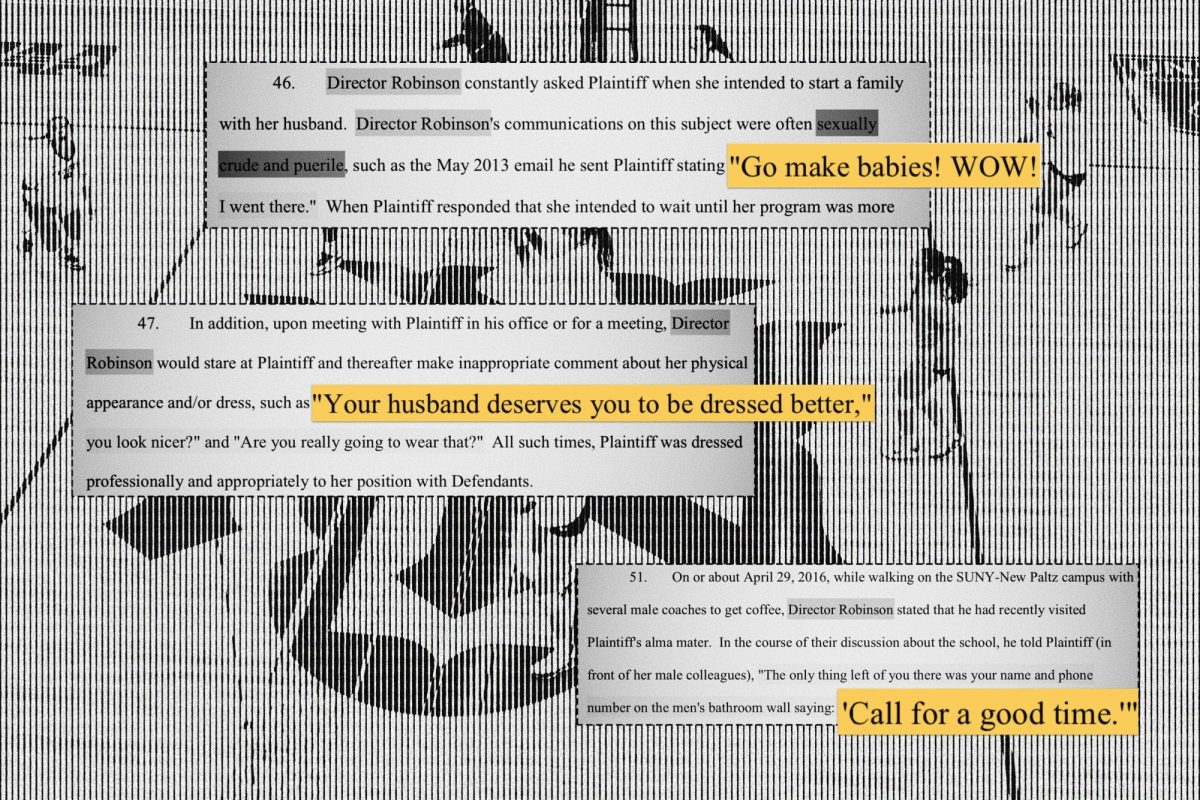

Among the popular cryptocurrencies, Bitcoin has been plagued by extreme instability in recent months, with the market price soaring and crashing in mere days or weeks. Between December 2017 and January 2018, the price of Bitcoin fell from $19,000 to under $10,000, according to Coinbase, a platform for buying and selling cryptos in the United States.

But Chen wasn’t investing alone.

He had the help of a group called Trace Capital, an organization started by Gallatin junior Leo Tulchin and his former roommate, who chose to be referred to simply as Brandon. Brandon is a former NYU student who dropped out to pursue other opportunities.

Brandon, who was used to trading traditional stock, dipped his toes into crypto in 2015. Shortly after, he began heavily trading coins. In September 2017, Brandon adapted an algorithm for traditional stocks to predict market trends, using gathered information to gauge market risk.

“I take a very unorthodox approach to trading and analysis,” he said.

Brandon predicts spikes and crashes in the crypto market by gathering data and recognizing trends.

“If news comes out in Hong Kong right now, when would that hit the [United States]?” Brandon said, posing a hypothetical. “When it hits, that’s when we would see the next drop.”

He uses this information to advise his investors on when and where to leave their money, as well as when and where to pull out.

“In a lot of cases, the market will fall and then spike back up,” Brandon said. “It’s like dominoes, where is the next domino going to fall?”

Through his analysis, Brandon was able to predict the massive Bitcoin crash in China in September 2017.

After that, it only took him a week to start Trace Capital and get his friends involved.

“I became friends with him and invested $1,000,” Leo Tulchin said. “In 10 months, that $1,000 grew to $18,000.”

Brandon’s circle of crypto traders expanded in the following months; they exchanged advice and helped each other manage investments. Tulchin started reaching out to people he knew in the business and investment world to get them involved.

“The good amount of these people are in our parents’ generation, who have been more traditional business people and investors,” Tulchin said. “They connected with Brandon, and our network started growing. We’re now managing around 15 people and working with a sizeable investment pool.”

Brandon and Tulchin’s venture has peaked the interest of many venture capitalists and traditional investment firms. One fund even tried to buy Trace and Brandon’s algorithm. The offer was turned down.

Now, Trace focuses its trading in the cryptocurrencies Bitcoin, Ethereum, Litecoin and Ripple.

“It’s really hard to predict the markets right now, and part of my success is because of Trace because Brandon gave me the tips,” Chen said. “We’re trend followers. If there’s a chance to make money, we’re there. It doesn’t matter if the underlying asset doesn’t have much value.”

Brandon claims that Trace Capital is moving toward incorporation.

But for students who aren’t being guided by an algorithm, the realities of volatile crypto markets have hit hard.

Stern freshman Anurag Gautam invested $100 in Bitcoin and $100 in Ethereum about a month ago.

“The market was really good at the time so I thought it was a good time to get in,” Gautam said. “I realized it wasn’t that great of an investment because $100 couldn’t make me a lot. My dad and I later put $750 into Bitcoin.”

The recent dip in the value of Bitcoin has taken a significant toll on Gautam’s investment.

“Recently, the markets have been really bad,” he said. “There was a day where it even hit $9,500. It’s kind of my dad’s money too, and I don’t like the fact that I’m playing with his money. At this point, if I break even or make a little profit, I’ll sell it and give my dad his money back.”

LS freshman Karishma Mohan invested money in Bitcoin on her birthday a few months ago. She has since seen the value of her investment fluctuate greatly.

“It’s very up and down,” Mohan said. “There have been times where I have lost thousands of dollars overnight. There was one drop that happened like a month ago where in 48 hours, it increased almost 50 percent; but like a day after, it basically dropped.”

But the market’s instability hasn’t deterred students from investing their money in cryptocurrencies. Gautam described Bitcoin as the gold standard.

“I think cryptocurrencies are the future,” he said. “I think it’s a good time to invest. Over break, I took a good amount of time to research and I’m a strong believer in blockchain technology. I believe in blockchain technology more than I believe in crypto.”

Gautam’s beliefs stem from the fact that blockchain technology keeps a continuous log of all transactions made through online currencies. The system is supposedly unhackable.

“Everyone is held accountable to the same standard because of the blockchain technology,” he said. “Everything is digital; it’s a like a ledger. Every transaction is the right transaction.”

Gautam said he plans to invest in smaller cryptocurrencies in the future.

“I’m planning on starting a company soon and when I start making money, I want to invest in smaller cryptos — not Bitcoin,” he said.

Mohan described Bitcoin as worth it in the long run.

“It’s basically just high risk, high reward,” she said. “A lot of people, even though they know it’s very volatile, go with that notion that they can cash out really big. A lot of people don’t know when to take it out — that includes myself.”

Despite the risk, Mohan remains a believer in Bitcoin.

“I have a lot of faith in Bitcoin,” Mohan said. “Bitcoin has a very long pattern of coming up after drops. For comparison, I have also invested in Ethereum and Litecoin and those tend to have a very short-lived peak and then drop. Those probably won’t increase again. I just trust Bitcoin more.

A version of this article appeared in the February 5 print edition.

Read more from Washington Square News’ Money feature.

Email Sakshi Venkatraman at [email protected].

Venky Venkatraman • Feb 22, 2018 at 12:33 am

This student was given credit as a source of an eerily similar article in the NY Post.

The following verbiage is now included under that article:

Editor’s Note: A story in the Washington Square News NYU’s independent newspaper by Sakshi Venkatraman was used as source material for this article.

Kudos to the NY Post for rectifying this omission – see below:

From: Michael Gray [mailto:[email protected]]

Sent: Wednesday, February 21, 2018 1:55 PM

To: [email protected]

Subject: NYU/BTC

Mr. Venkatraman, I sent the below to your daughter’s email address.

Dear Ms. Venkatraman,

Please see new version of our NYU, bitcoin story on the web: https://nypost.com/2018/02/17/nyu-student-paid-his-tuition-with-bitcoins-profits/

Please accept my apologies for not putting citation in the original story.

MICHAELGRAY

Sunday Business Editor, New York Post

1211 AVENUE OF THE AMERICAS, NEW YORK, NY 10036

WORK: 212.930.8592 | MOBILE: 917.686.3990

[email protected]

nypost.com

From: Venky Venkatraman [mailto:[email protected]]

Sent: Wednesday, February 21, 2018 9:24 AM

To: ‘[email protected]’

Cc: ‘[email protected]’ ; ‘[email protected]’ ; ‘[email protected]’

Subject: Possible plagiarism

Importance: High

The article “NYU student paid his tuition with bitcoin profits” (https://nypost.com/2018/02/17/nyu-student-paid-his-tuition-with-bitcoins-profits/ ) in your paper appears to copied without attribution from my daughter’s article in her college newspaper’s article “Students Pay Tuition through Cryptocurrency Investments” (https://www.nyunews.com/2018/02/04/02-05-news-bitcoin/ ) a few weeks ago.

One would think a serious newspaper would not “borrow” from a student’s article without giving her any credit.

Is there an explanation?

Venky Venkatraman

Venky Venkatraman • Feb 11, 2018 at 5:39 pm

Good article and excellent related podcast by this author!

To get some additional perspective from people in the cryptocurrency business, one may want to read this article on CNBC and listen to entrepreneur, Dan Novaes, co-founder and CEO of Current:

https://www.cnbc.com/2018/01/17/newbie-bitcoin-day-traders-are-going-to-get-slaughtered-says-blockchain-entrepreneur.html

He says (and I agree) “If people are going to day trade cryptocurrencies, and they don’t know what they are doing, they’re going to get slaughtered”.

That is why I wish this author had not titled her article “Students Pay Tuition through Cryptocurrency Investments”. That seems to suggest that trading in cryptocurrencies was a viable way to fund your college education! In my opinion, day trading in cryptocurrencies to pay for college is as risky as driving down from New York to Atlantic City with the money your Dad gave you to pay for the first semester and playing the slot machines hoping that you will win big and use the funds to pay for your entire college education!! You may lose all the money and end up having to work at the local McDonalds instead of attending college!!!