Stern Professor Advocates for the Breakup of Big Tech Companies

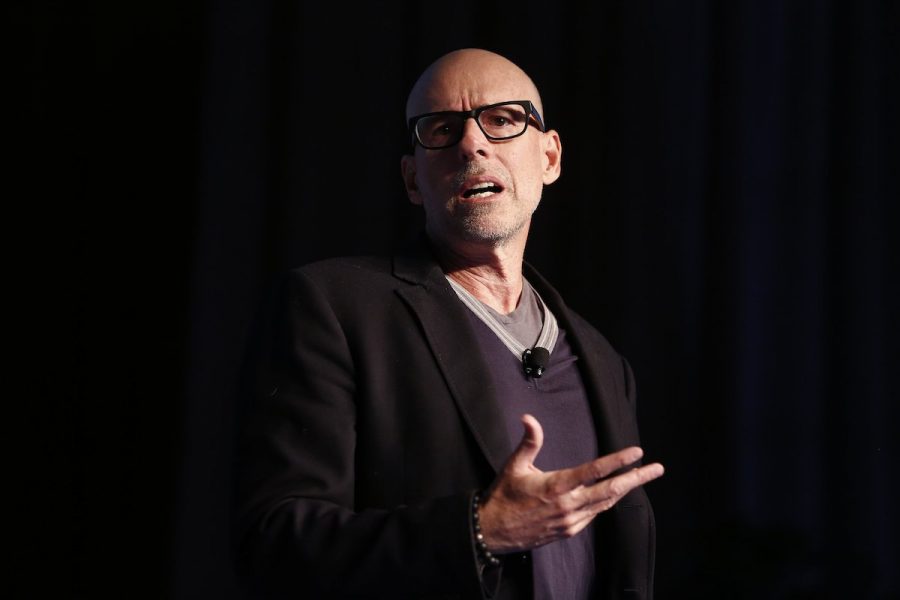

Scott Galloway speaking at a conference in Munich in late January.

February 14, 2018

Stern School of Business Professor Scott Galloway spoke about his predictions for the future of the tech industry last month in Munich at the Digital Life Design global conference, a three-day event during which speakers present their research findings on patterns and developments in businesses.

Not only is Galloway a professor at NYU, but also the founder of L2 Inc, a business intelligence firm that analyzes and advises brands’ digital performances. At last year’s conference, Galloway correctly predicted that Amazon would acquire Whole Foods and that hacking, phishing schemes and ransomware would reach crisis proportions — proven in 2017 when Equifax, Uber, the Securities and Exchange Commission and Chipotle were all hacked.

Galloway claimed that he risks losing some of his clients — companies represented by L2 — over his idea of breaking up big technology.

“Regardless of who our clients are, we provide unbiased research on how brands perform across four dimensions of digital — site and e-commerce, digital marketing, social media and mobile,” Galloway said in an email. “Similarly, I make unbiased opinions rooted in my own research and experience working with, working for and observing these firms.”

A few of the notable predictions Galloway made for 2018 are that Amazon will pass Apple in value; cryptocurrencies will crash by over 50 percent in a month; Twitter, Snapchat and Pinterest will be acquired for between 25 and 50 percent of their all-time highs; Amazon will acquire Carrefour or Nordstrom; and that the breakup of big tech companies will begin in Europe or a red state in the U.S.

Along with these predictions, Galloway revealed the faults of several giant tech companies throughout his speech: Amazon’s acquisition of Whole Foods crashed market values of grocery businesses much larger than Whole Foods.

Galloway’s attack focussed a lot on the Big Four tech companies — Apple, Facebook, Amazon and Google.

“They destroy jobs, they avoid taxes and they lie to regulators,” Galloway said in an email. “And guess what, the market is failing. The Four are dominating the press and markets, creating a concentration of power that fosters premature death for big companies and infanticide for small firms. Think about which ecosystem would create more jobs and shareholder value, inspire more investment, broaden the tax base and lower rents via increased competition from firms. An ecosystem with Amazon, Apple, Facebook and Google? Or an Ecosystem with Amazon, Amazon Web Services, Apple, iTunes, Facebook, WhatsApp, Instagram, Google, YouTube?”

Galloway further emphasized at the conference that breaking up big tech corporations is not a form of government overreach but an integral element to revitalizing competitive markets.

“I believe the main reason that we should break these firms up is that a key trait of capitalism is that the market leads, not government,” Galloway said. “A key component of the capitalist economic model is that when markets fail, and they do, we have referees on the field to throw a yellow flag and restore order.”

Despite the risk it poses to his business, Galloway said that breaking up big tech is necessary to maintain capitalism.

“We should break them up because key to our capitalist way of life is to maintain competition to prevent market failure, as we did by breaking up the railroads and Ma Bell,” he said. “This type of intervention is not an attack on capitalism, but full-throated capitalism. It’s time.”

Email Louise Choi at [email protected].

Frank Rolen • Feb 16, 2018 at 5:38 pm

School Shootings

I think congress should initiate a program whereby each school in the US would have two armed guards and cameras around the buildings to protect the students. Also, they should screen each student for mental illness and get help for them if needed. This would make everyone happy and gun control would not be needed.